Meesho and its upcoming IPO.

✅ What’s the video about — key theme

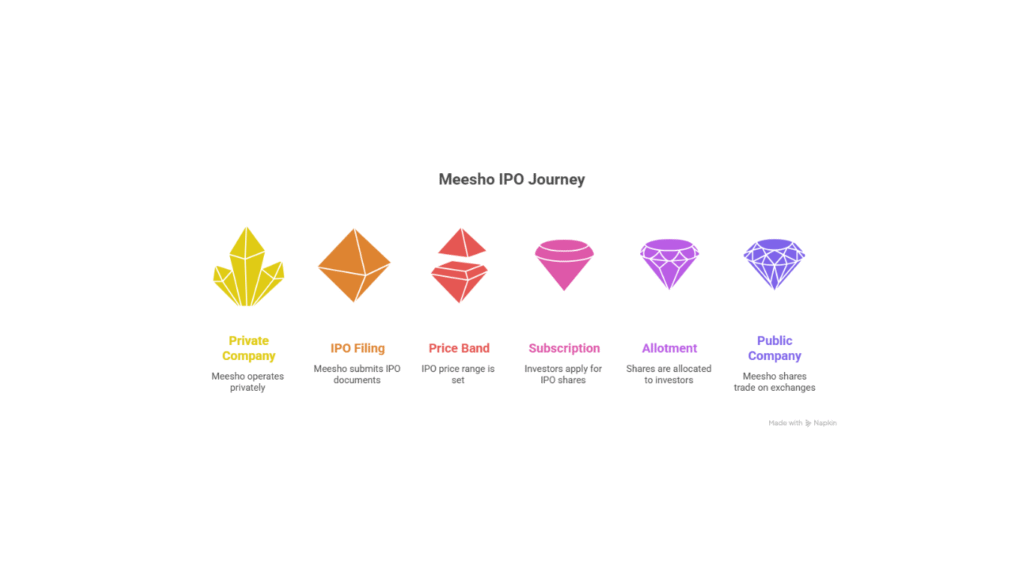

- The video discusses the impending IPO of Meesho.

- It explores whether Meesho can challenge big players like Amazon India and Flipkart.

- It also touches on the “GMP” (grey market premium) associated with the IPO — a signal many retail investors watch to gauge potential listing gain.

📄 Important facts & numbers about Meesho IPO

From publicly available IPO filings & media coverage

- IPO price band: ₹105 – ₹111 per share.

- Issue size: ~₹5,421 crore in total.

- Fresh issue: ~₹4,250

- Offer for Sale (OFS) by existing investors: balance share portion.

- IPO dates: Opens on 3 December 2025, Closes on 5 December 2025

- Tentative listing date: 10 December 2025

- Lot size (minimum for retail investors): 135 shares

🎯 Company / Business Model Context

Why Meesho is seen as a strong value-ecommerce contender (as noted in the discussion):

- Meesho operates a zero-commission model for sellers. Instead of charging seller commissions or platform fees, it earns via logistics, fulfilment, advertising and data services. That helps keep product prices low — attractive in “value-focused” segments. ([The Economic Times][3])

- Its main target audience: value-conscious customers in smaller towns, Tier-2/Tier-3 cities — i.e. buyers less served by premium e-commerce players. ([Business Today][4])

- According to recent data, in the 12-month period ending mid-2025, Meesho became India’s largest e-commerce platform by annual transacting users and number of placed orders in its category. ([The Economic Times][3])

Because of this model and scale, many see Meesho as well positioned to compete with Amazon/Flipkart — particularly in budget/value segments (which the video highlights as well).

⚠️ Risks & What to Watch Out For

As also discussed (or implied) in video + IPO analysis:

- While Meesho has scale and reach, profitability remains uncertain. For many similar firms, high discounts + logistics costs + competition make sustainable profits hard. ([JM Financial Services][1])

- The valuation (at IPO price band) is quite ambitious — meaning performance (growth, margin, user retention) post-IPO will matter heavily. ([JM Financial Services][1])

- Competition from big players (Amazon, Flipkart, maybe new entrants) is strong. As larger players adjust pricing / commission / seller policies (some already reducing seller fees), Meesho’s value-based edge could be challenged. ([Business Today][4])

So — good opportunity, but not risk-free.

🧮 What “GMP” Means and What It Indicates

- GMP = Grey Market Premium — an informal indicator of how much shares are being traded (or expected to trade) above IPO price before listing.

- As per recent sources, GMP for Meesho IPO has been reported in a range (~₹29–₹33 per share) by some analysts — suggesting potential listing gains of ≈ 25-30%. ([Firstock][5])

- But GMP is not official — it reflects demand & sentiment in unofficial markets. It can fluctuate rapidly. ([Firstock][5])

- Hence, GMP gives a “preview” — but shouldn’t be seen as guarantee of listing gain or long-term value.

The blog uses that to discuss whether investors should expect a “pop” on listing or think longer term.

📈 Why This IPO Matters (For Market, Investors, Sector)

- This IPO could be one of the major public listings of 2025 in India’s e-commerce/startup space — showing strength & revival of India tech/startup IPO market.

- If Meesho succeeds, it could validate the “value-ecommerce + mass-market + low-price + tech-enabled logistics” model — encouraging more similar ventures targeting Tier-2/3 & emerging-market segments.

- For investors: as the IPO’s public retail allotment is not huge (retail quota limited), but demand (and GMP) is high, there could be short-term listing gains. At the same time, long-term success depends on execution, market share retention, costs, and competition response.