Knowledge IPO- DRHP Analysis

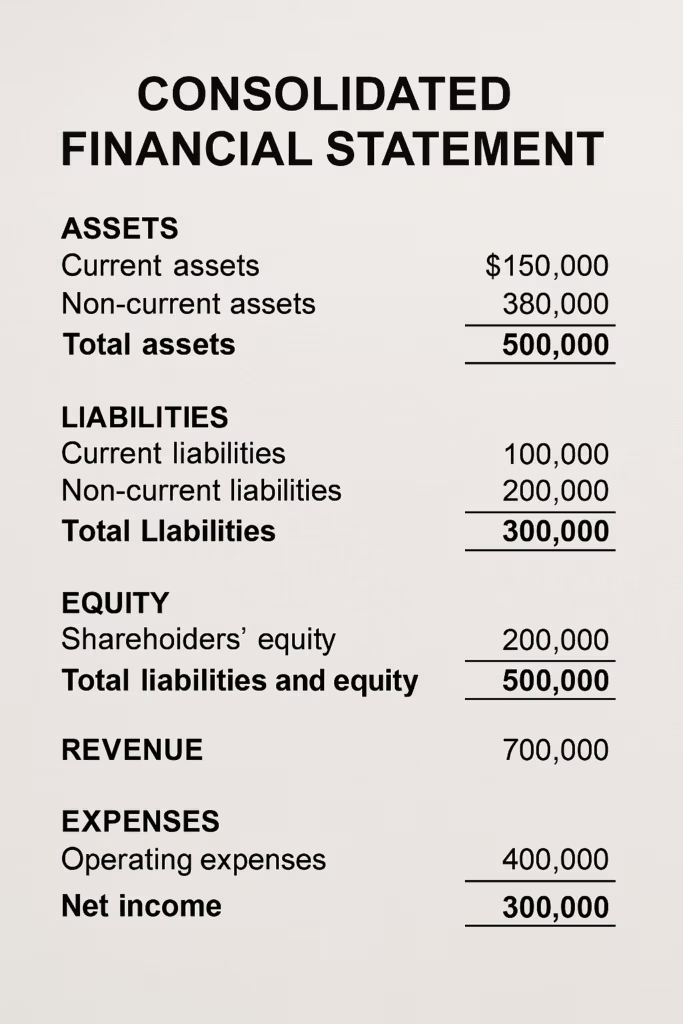

Facebook-f Twitter Linkedin-in Pinterest-p Vimeo-v More than 2 results are available in the PRO version (This notice is only visible to admin users) About us Contact us Financial Statement Analysis How to Read Analyse Financial Statements in Detail Fundamental analysis for stocks post-1 What is Financial statement analysis post-2 Importance of FSA(Financial statement Analysis) post-3 What are the different financial statements? post-4 Who uses Financial statement Analysis? post-5 Credit Rating Agencies post-6 Understanding Annual Report post-7 Different parts of Annual Report post-8 Standalone vs consolidated Financial statements post-9 IPO’S Milky Mist IPO DRHP Analysis NSDL IPO DRHP analysis GNG Electronics IPO Review AB(Anthem biosciences) IPO – DRHP Analysis Stock Market News& Updates ideas About us Contact us Financial Statement Analysis How to Read Analyse Financial Statements in Detail Fundamental analysis for stocks post-1 What is Financial statement analysis post-2 Importance of FSA(Financial statement Analysis) post-3 What are the different financial statements? post-4 Who uses Financial statement Analysis? post-5 Credit Rating Agencies post-6 Understanding Annual Report post-7 Different parts of Annual Report post-8 Standalone vs consolidated Financial statements post-9 IPO’S Milky Mist IPO DRHP Analysis NSDL IPO DRHP analysis GNG Electronics IPO Review AB(Anthem biosciences) IPO – DRHP Analysis Stock Market News& Updates ideas