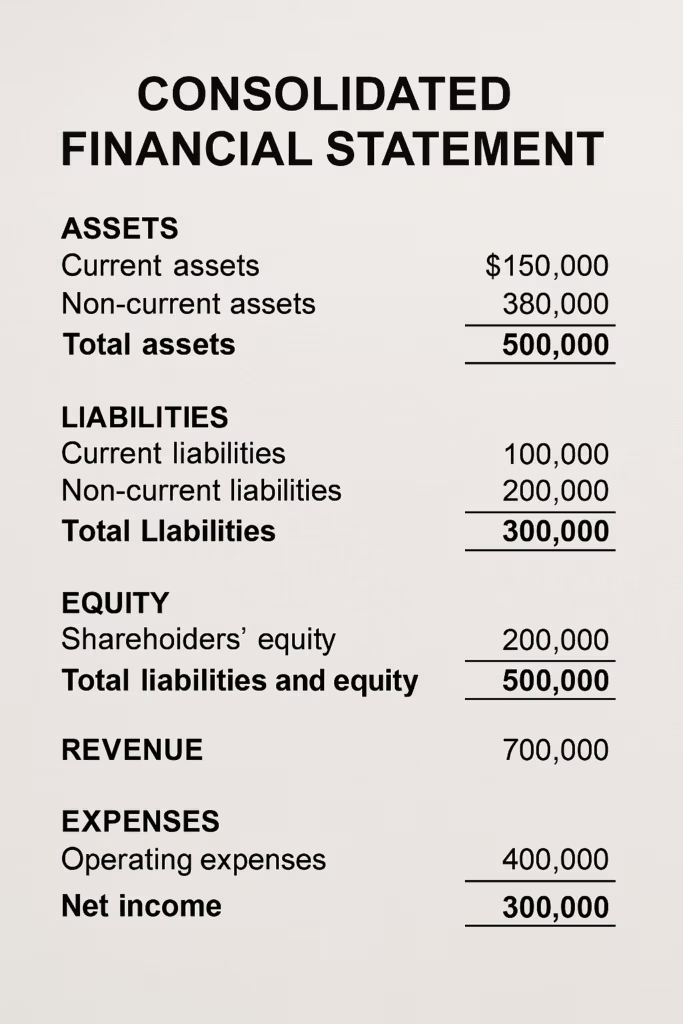

Consolidated Financial statements post-11

Consolidated Financial statement takes parent company Finally, standalone statement takes child company, consolidated statement takes parent company.

Standalone Financial Statements post-10

A Standalone Financial Statement includes profit and loss assets and liabilities of only the core company. A Standalone Financial Statement take only child company.

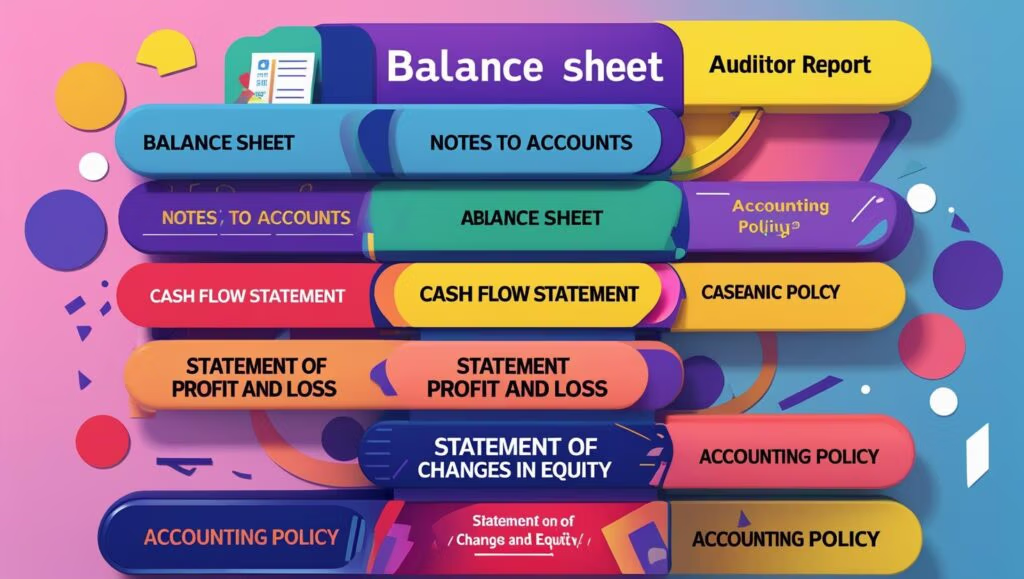

Different parts of Annual Report post-8

How to normalize the data? company in loss Average profit huge profit loss due to fire: Fire is an accident that won’t happen every year unless. it is very fire prone business. Thus, losses due to such fires are on offs and must be removed. Huge profits on trading: if the company has made one-time profits from trading activities. it should be also removed. before analyzing financial statements. unless it is a trading company, these profits won’t happen every year. profit or loss on sale of subsidiaries: similarly, any profit or loss on sale of any subsidiary should also be removed as it is non-recurring.

Who uses Financial statement Analysis? post-5

Banks Banks and other financial institutions involved in the lending business must understand a company’s past performance. They need to determine whether a company can be lent a money or not. Interest coverage ratio formula and debt-equity ratio formula sometimes, banks may offer a loan with low interest NOTES TO ACCOUNTS Apart from the three reports

Importance of FSA(Financial statement Analysis) post-3

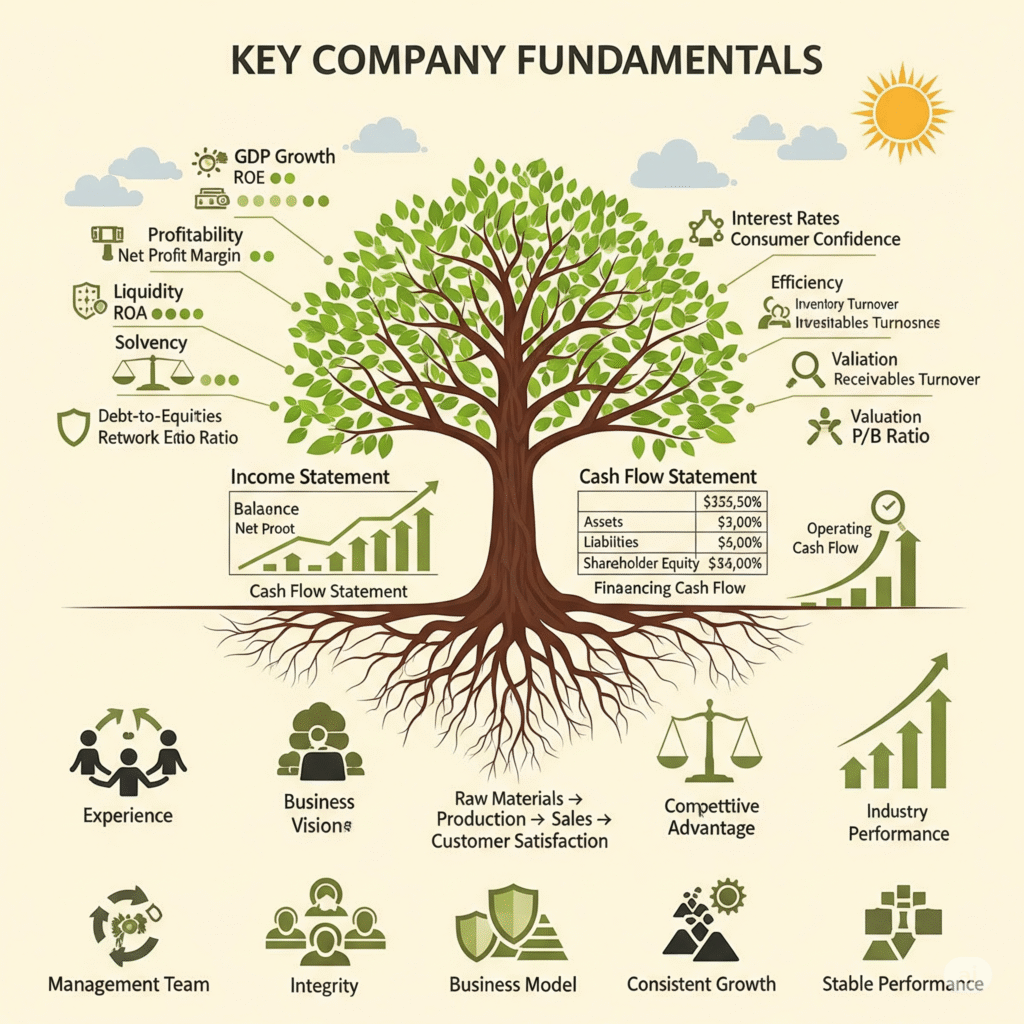

In financial statement analysis helps decision makers understand three key parameters (1) the past performance of the company (2) Detailed information of company fundamentals (3) indicators about the company’s future performance (1) the past performance of the company : Financial data is always viewed in comparison to past data. This helps us understood how the company and its numbers have changed. (2) Detailed information of company fundamentals Each important fundamentals are broken into finer parts. the root cause of problems if any. (3) indicators about the company’s future performance Fundamentals the base of activities like forecasting. in forecasting you understand the past,present of the business you must scan stocks

What is Financial statement analysis post-2

In fundamental analysis of stock means Detailed information of company’s financials and to understand its performance in detail in upcoming posts our goal is to key decisions- Lending Borrowing Investment Decision

Fundamental analysis for stocks post-1

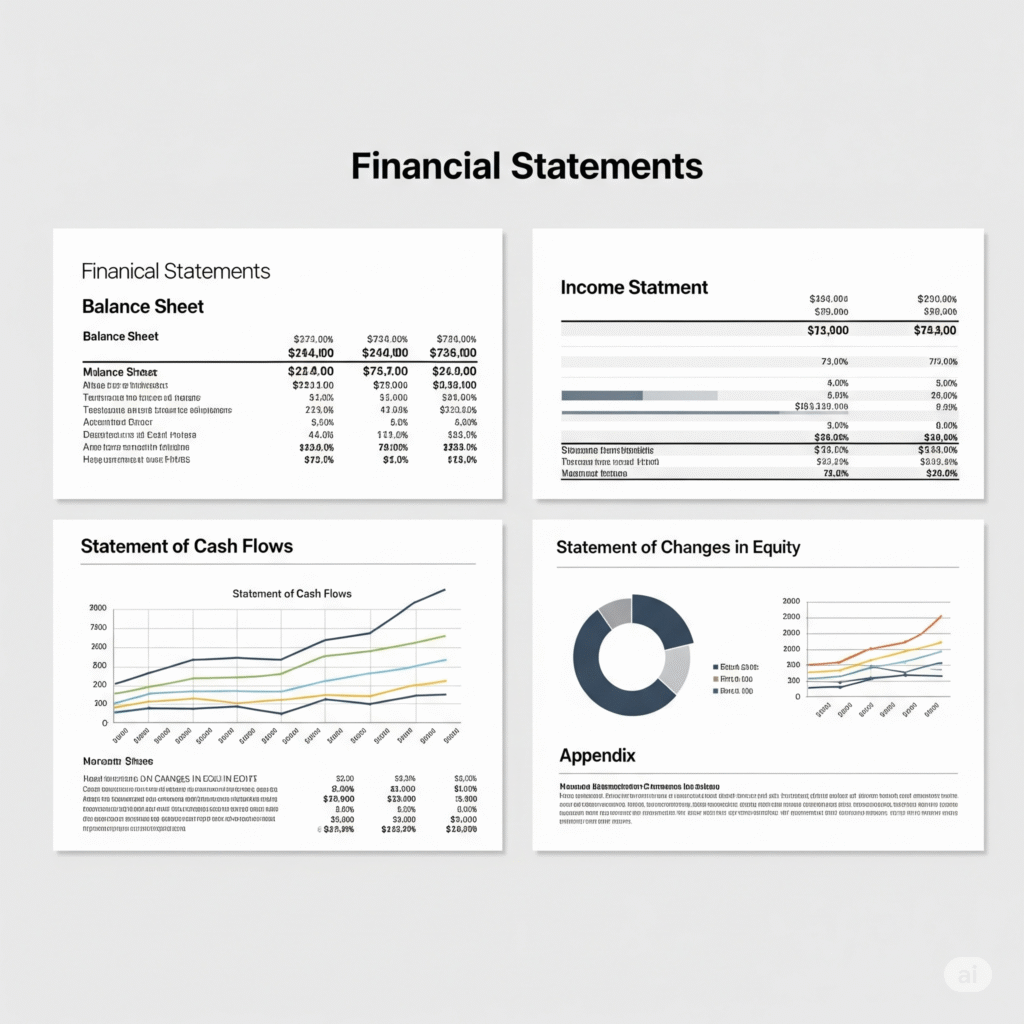

what is financial statement analysis? in this article we will learn fundamental analysis.in fundamental analysis income statement, statement changes in equity,balance sheet and cash flow statement are very important to analysis we can use excel sheet to analyse any statement this excel sheet help to the whole financial statement into multiple parts like Income statement, balance sheet and cash flow statement these fundamentals help to stock good or bad. Different financial statements company you must understand the strengths and weaknesses of company

How to Read Analyse Financial Statements in Detail

post 1 Numbers never lie is a well know saying, but it’s essential to understand how to interpret them to gain crucial information for your finance career. In the world finance, the decisions you make acquiring a business , giving a loan or going for an IPO. That’s why financial analysis is so vital – it helps you make informed decisions